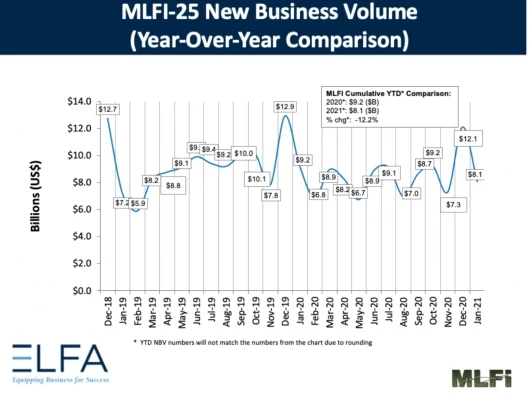

根据来自美国设备融资领域25家公司的经济活动数据,1月份的新业务总额为81亿美元,比去年12月份的121亿美元下降了33%。与2020年1月相比,下降了12%。

根据设备租赁和金融协会的说法,月租和金融指数使用这25家公司来代表该行业的各个领域。月度环比下降是由于“新业务活动通常在季度末,年末出现激增”。

信贷批准总额为76.2%,高于12月份的75.2%。

协会总裁兼首席执行官Ralph Petta在一份声明中表示:“一月份新业务量相对疲软,这是许多设备融资公司第一季度早期业务活动的典型表现。”这些公司的投资组合质量也处于健康范围。初步的经济预测表明,随着2021年美国经济的总体状况改善,设备融资活动将会加速。

原文如下:

Leasing Business Falls 33%: Finance Group

Overall new business volume for January was $8.1 billion, a 33 percent drop from $12.1 billion in December, according to a measure of economic activity from 25 companies in the equipment finance sector. Compared to January 2020, volume was down 12 percent.

The Monthly Leasing and Finance Index uses these 25 companies to represent a cross section of the industry, according to its publisher, the Equipment Leasing and Finance Association. It said the month-to-month drop was due to the “typical end-of-quarter, end-of-year spike in new business activity.”

Credit approvals totaled 76.2 percent, up from 75.2 percent in December.

“New business volume was relatively soft in January, as is typical for early Q1 business activity for many equipment finance companies,” said ELFA president/CEO Ralph Petta, in a statement. “Portfolio quality for reporting companies is in the healthy range as well. Preliminary economic projections indicate that equipment finance activity should accelerate as overall conditions in the U.S. economy improve in 2021. Time will tell.”

Source: ELFA

免责声明:本网站内容来自作者投稿或互联网转载,目的在于传递更多信息,不代表本网赞同其观点或证实其内容的真实性。文章内容及配图如有侵权或对文章观点有异议,请联系我们处理。如转载本网站文章,务必保留本网注明的稿件来源,并自行承担法律责任。联系电话:0535-6792765